With a revocable trust the grantor can remove property as needed and make modifications.

Florida revocable living trust form.

During the client session or the initial interview the attorney will be asking the property owner about the details of his family himself and his properties.

Download this florida revocable living trust form in order to set aside certain assets and property of your choosing in a separate flexible entity for the benefit of your chosen beneficiaries.

Upon your death or when the beneficiary reaches a certain age.

Revocable living trusts questionnaire form property owners must create a living trust or any legal form with the guidance of an attorney.

Use the search form below to search for free printable legal forms.

The cost of establishing a living trust in florida depends on how you decide to create it.

A living document is a document which you may continually edit and update.

Texas search for specific purpose example.

The term revocable means that you may revoke or terminate the living trust at any time.

How do i choose between a revocable living trust and an irrevocable living trust.

Florida revocable living trust form.

To put it simply when you create a revocable living trust you still have a form of control in being able to change or terminate the trust therefore it is.

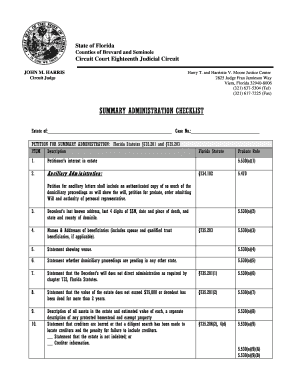

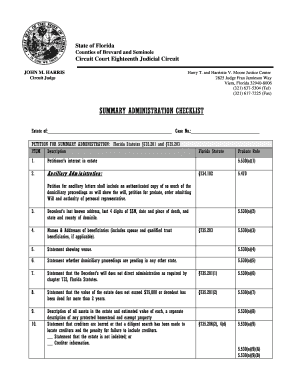

The revocable or living trust is often promoted as a means of avoiding probate and saving taxes at death and is governed by chapter 736 florida statutes.

How much does it cost to create a living trust in florida.

The answer will depend on your circumstances and your reason for wanting to make a trust agreement.

Florida living trust add to cart the florida living trust is an estate planning tool designed to avoid probate while providing long term property management.

Florida living trust forms irrevocable revocable a florida living trust allows a person the grantor to legally define the recipient s of their assets after they die.

The florida revocable living trust is a legal form created by a person a grantor into which assets are placed with instructions on who will benefit from them.

It is flexible because you can specify when you want the property or assets distributed i e.

The grantor still owns the property in the trust and pays taxes on it as normal.

The grantor appoints a trustee to manage the trust in the event they become mentally incapacitated.