For residential pv systems consumers who install solar electric systems can receive a 30 tax credit for systems placed in service from january 1 2006 through december 31 2016.

Florida solar tax credit 2017.

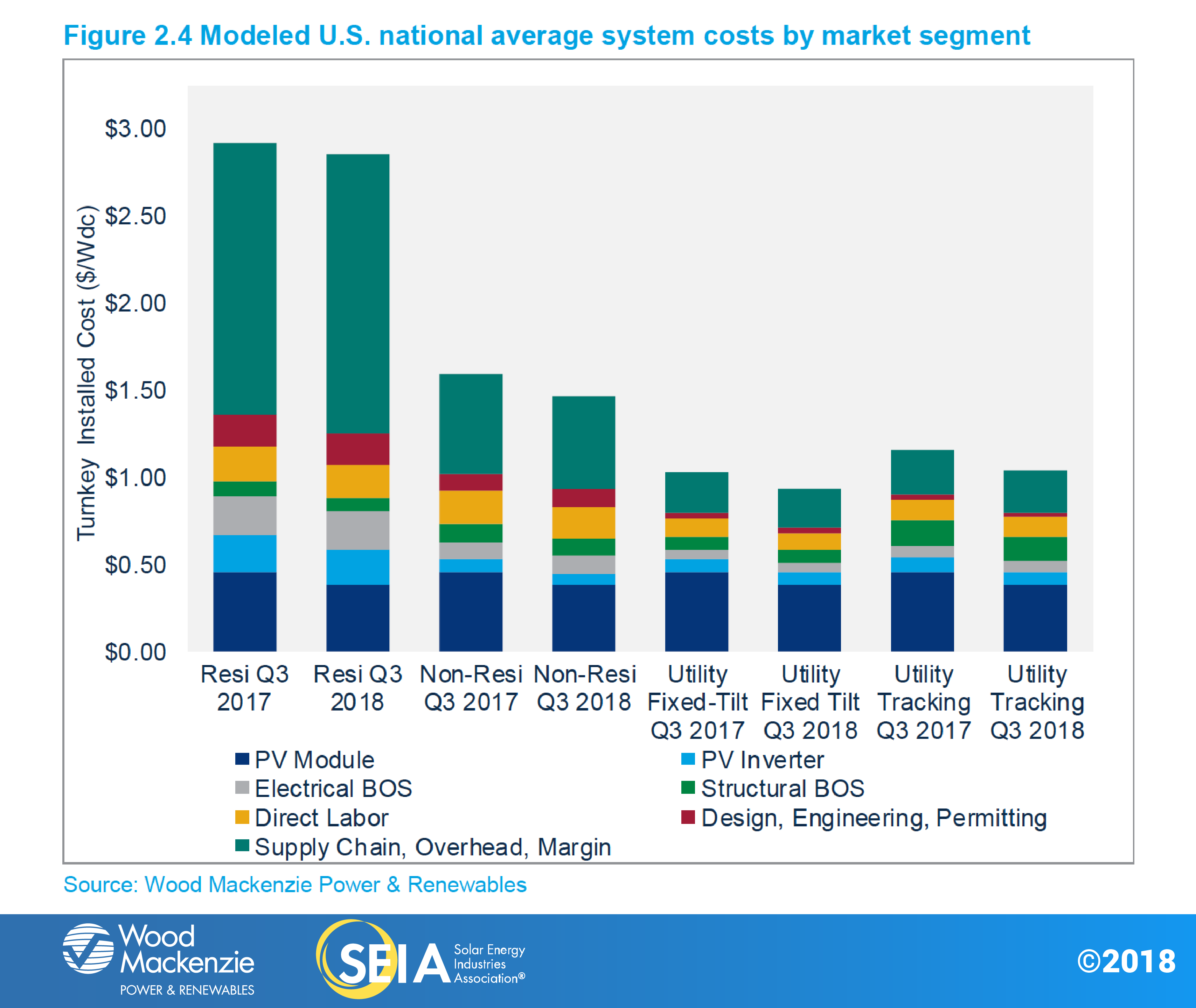

Especially when used in combination with the 30 federal solar tax credit the incentives listed below can significantly reduce the cost of installation of solar panels for your home or business.

A tax credit cap of 2 000 applies in 2006 2008.

A series of extensions pushed the expiration date back to the end of 2016 but experts believed that an additional five year extension would bring the.

Beginning january 1 2009 the tax credit cap no longer applies.

In addition to florida s net metering policy and tax exemptions to encourage solar energy the federal government gives you another huge incentive known as the investment tax credit itc.

What it does is give you a credit of 30 based on the amount to install your system.

Florida is a grid parity state making solar power cheaper than the residential utility rates.

In 2019 the tax credit can reduce the cost of a solar installation by 30 7 including a solar battery purchase.

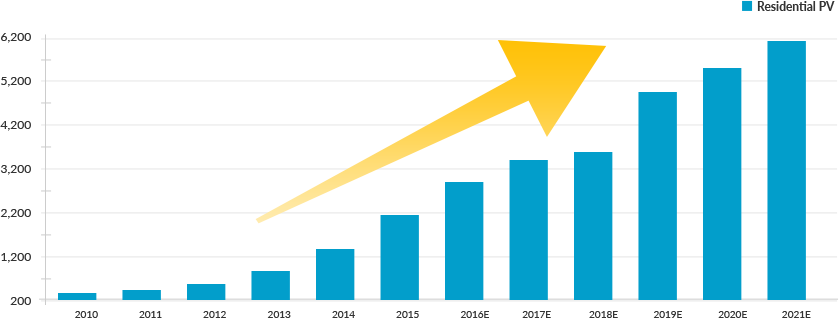

As you can see the declining price of solar panels has led to a drastic increase in the number of installed systems.

You calculate the credit on the form and then enter the result on your 1040.

Home tax credits rebates savings please visit the database of state incentives for renewables efficiency website dsire for the latest state and federal incentives and rebates.

For example if your system was 30 000 you get a credit of 9 000 taken off of your tax liability.

What does the federal solar tax credit extension mean for the solar industry.

This generous rebate effectively knocks off 26 percent of the cost of your new solar energy system right.

The federal incentive tax credit for solar or itc is the most touted incentive for going solar.

8 that means if you purchase a 6 kilowatt system for 18 300 you ll pay.

In fact q3 2019 saw the highest number of solar installations ever less solar was installed in 2017 compared to 2016 but this was mainly because the 30 tax credit was scheduled to expire at the end of 2015.

The federal solar tax credit.

In addition to florida s state solar programs you ll be eligible for the federal solar tax credit if you buy your own home solar system outright.

To claim the credit you must file irs form 5695 as part of your tax return.

If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.